Taxes & stimulus: Help Homeownership?

Many Americans look forward to the tax season because they’re expecting a tax refund from Uncle Sam. Last year, the Internal Revenue Service (IRS) sent $324 billion back to taxpayers. “Nearly 8 out of 10 received a tax refund worth an average of $2,895”, according to Business Insider. This average does vary by state but provides an idea of what to expect from the IRS.

If you’re planning to buy a home this year, saving for a down payment is one of the most important steps in the process. The down payment is the money you give to the home’s seller upfront. The rest of the payment to the seller comes from a home loan that your mortgage lender provides.

One of the best ways to jumpstart your savings is by starting with the help of your tax refund or because of the circumstances and year, your stimulus can help too. Combined together, you could have a sizable down payment.

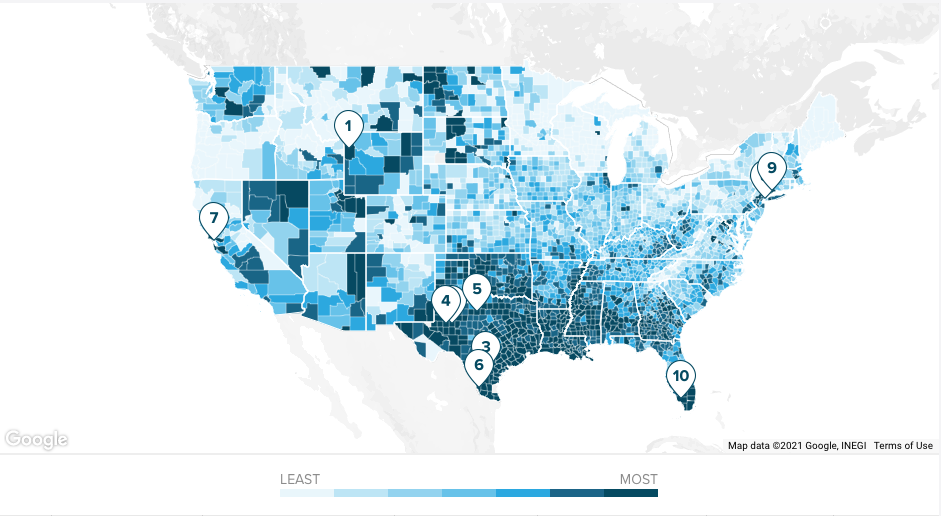

Using data from the Internal Revenue Service (IRS), it’s estimated that Americans can expect an average refund of $2,925 when filing their taxes this year. The map below shows the average anticipated tax refund:

Today, the average down payment is between 5 to 10% — not 20%, as a lot of people assume. With options like Freddie Mac’s 3% down Home Possible® mortgage, qualified borrowers are able to make a down payment of as little as $6,000 for a $200,000 home.

In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

Down payment assistance programs can also help you bridge the cash gap. With over 2,500 programs across the country that can help you save on your down payment and closing costs, a great place to start is researching where you live.

How can your tax refund help?

If you’re a first-time buyer, your tax refund may cover more of a down payment than you realize.

The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

Should I buy a home?

No matter what you choose, you need to talk to a real estate professional. Right now the market is crazy, and trying to navigate it yourself is extremely risky. You want to get the best deal possible for your situation.

Saving for a down payment can seem like a daunting task, but it doesn’t have to be. This year, your tax refund and your stimulus savings could add up big when it comes to reaching your homeownership goals.

How you choose to spend your tax return is obviously entirely up to you and even getting a tax return back this year can be considered a win, but if you want to create sustainable long-term wealth then consider using your tax return towards homeownership.

Contact me today with any questions.